Vll. ELIGIBILITY REQUIREMENTS

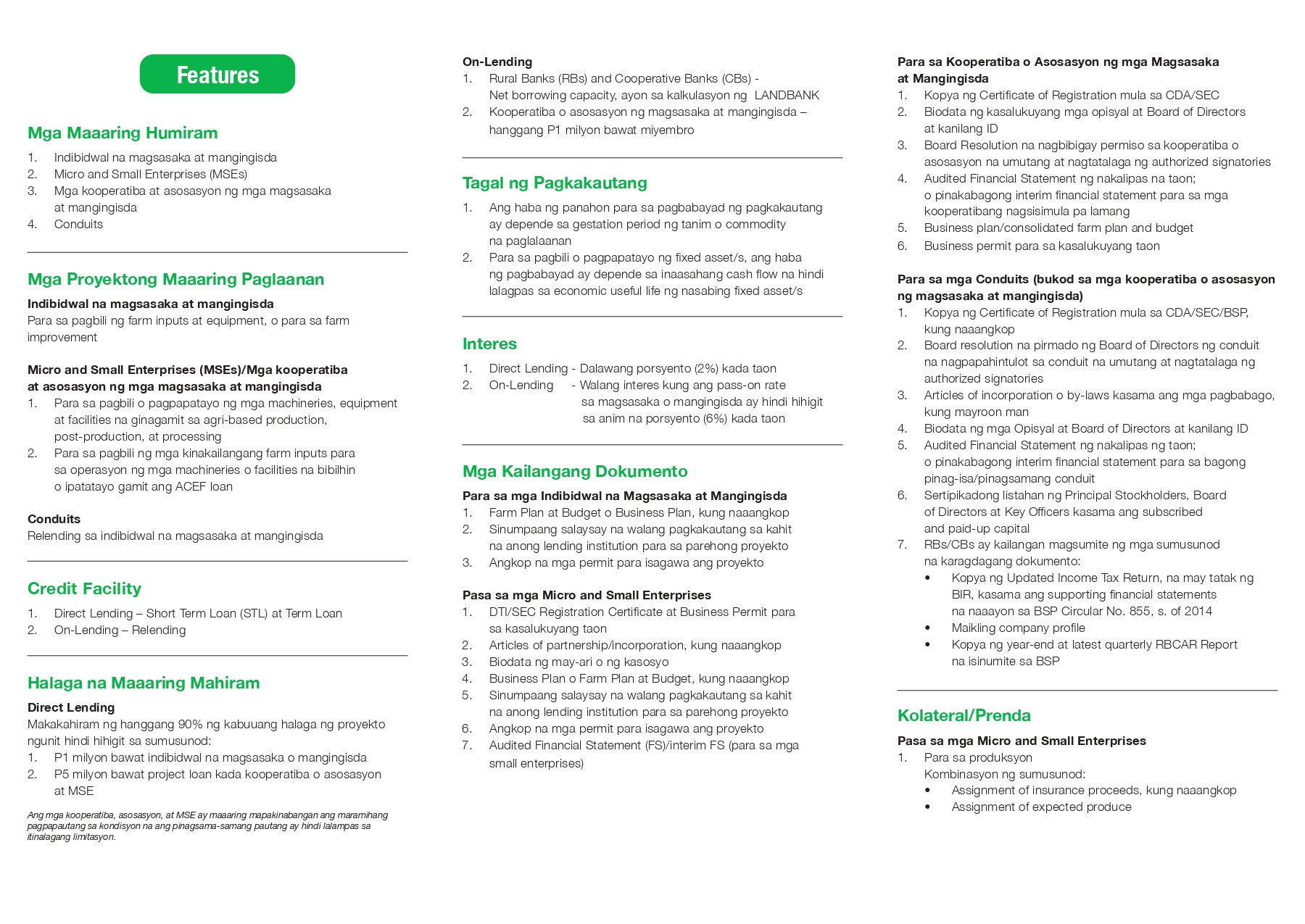

1. Individual Farmers and Fisherfolk:

- With viable project;

- No outstanding loan from formal lending institutions for the Same project being applied for; and

- With marketable surplus of the project or other confirmed sources of repayment.

2. Micro and Small Enterprises:

- Duly registered with the DTI/ SEC;

- No adverse findings on the borrower;

- With Available project; and

- No outstanding loans from other financial institutions, for the same project being applied for.

3. Farmer and Fisherfolk Cooperatives and Associations:

- Duly registered with the CDA/ SEC/ DOLE-BRW;

- Operational for at least 6 months;

- No adverse findings on the borrower;

- With core management team composed of manager, cashier and treasurer or equivalent positions; and

- With proven track record (experience, training and preparation members to implement the proposed project to be financed).

4. Conduits:

a. Rural Banks(RBs)/Cooperative Banks(CBs)

- No adverse findings in the borrower;

- Net Past Due Ratio of15%;

- RBCARofatleast10%;

- with Tier 1 risk-based ratio of or better,

- Profitable operations during the preceding year prior to loan application; and

- Minimum capital prescribed by BSP

For newly-consolidated or merged RBs/CBs with no credit dealings with LANDBANK, they must have profitable operations, for at least 6 months, provided they meet the other abovementioned RAAC for RBs/CBs.

- Microfinance Institutions

- PESO Rating of at least “3” (satisfactory) or passed the rating conducted by the Independent Rating company, whichever is applicable; and

- Profitable microfinance operations for one (1) year prior to loan application

- Farmer and Fisherfolk Cooperatives and Associations (pls. refer to Section VIL3)

VIII. DOCUMENTARY REQUIREMENTS

A. For Individual Farmers and Fisherfolk

- Loan Application (prescribed form attached as Exhibit 1.1)

- General Information Sheet;

- Business Plan or Farm Plan and Budget, as applicable;

- Sworn affidavit of no outstanding loans from any lending institution for the same project; and

- Barangay Clearance

B. Micro and Small Enterprise

- Loan Application (Exhibit 1.1)

- General Information Sheet;

- DTI/SEC Registration Certificate and current year Business Permit;

- Articles of Partnership/incorporation, if applicable;

- Bio-Data of owner and/or partner;

- Business Plan or Farm Plan and Budget, as applicable;

- Sworn affidavit of no outstanding loans from any lending institution for the same project; and

- Barangay Clearance

C. For Farmer and Fisherfolk Associations

- Loan application (Exhibit 1.1)

- General Information Sheet;

- Photocopy of Certificate of Registration:

– For cooperatives: Certificate of registration from the CDA

– For associations: Certificate of registration from either DOLE-BRW, SEC and other registering agencies;

- Bio-data of incumbent Officers and Board of Directors with ID;

- Board Resolution authorizing the Coop/Association to borrow and designating authorized signatories;

- Audited Financial Statement for the last year, or, latest interim financial statement for start-up companies;

- Business Plan/Consolidated Farm Plan and Budget; and

- Current year Business Permit

D. For Conduits (other than farmers/fisherfolk cooperatives and association)

- Loan Application (Exhibit 1.1)

- General Information Sheet;

- Photocopy of Certificate of Registration from CDNSEC/BSP, as applicable

- Board resolution duly signed by the conduit’s Board of Directors authorizing the conduit to borrow and designating authorized signatories;

- Articles of incorporation and/or by-laws including amendments thereto, if any;

- Bio-data of Officers and Board of Directors with ID;

- Audited Financial Statement for the preceding year; or, latest interim financial statement for newly consolidated and/or merged conduits;

- Certified List of existing principal Stockholders, Board of Directors and Key Officers together with subscribed and paid-up capital; and

- RBs / CBs are required to submit the following additional documents:

- Copy of Updated Income Tax Return, duly stamped as received by the BIR, together with the supporting financial statements, as applicable per BSP Circular No. 855, s. of 2014, as may be amended;

- Brief company profile; and

- Copy of year-end and latest quarterly RBCAR Report as submitted to BSP

All content is in the public domain unless otherwise stated.

All content is in the public domain unless otherwise stated.